VAT Registration Procedure

View Procedure

| Procedure Name | VAT Registration Procedure |

|---|

| Description | For VAT purposes, companies register with the Customs, Excise, and VAT Commissionerate under the National Board of Revenue. The company's VAT is regulated by the Customs, VAT and Excise Department of the region in which it operates. When an enterprise submits a VAT Registration application to the VAT authority an application must accomplish or enclosed the Trade License, Bank Solvency Certificate, TIN Certificate, Copy of BOI Registration & Deed of Agreement.

|

Responsible Agency

|

National Board of Revenue (NBR)

|

|

Legal Basis of the Registration

|

The Value Added Tax Act, 1991

|

|

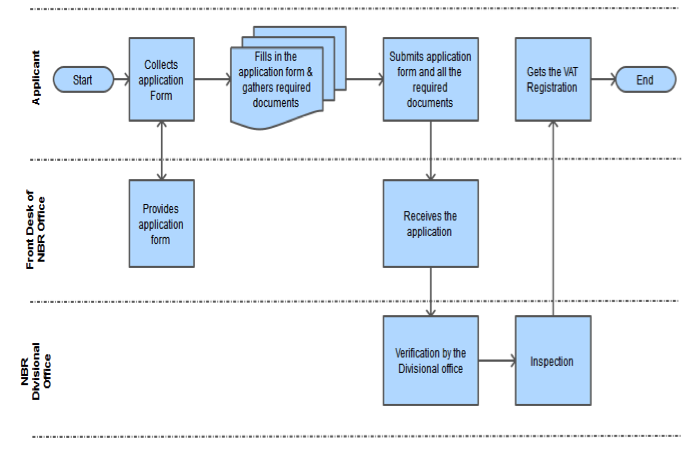

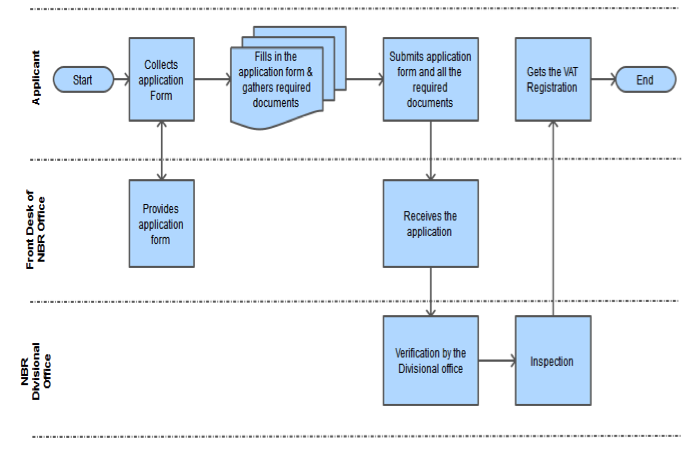

Process Step

|

Step 1: Collecting prescribed application form from the NBR Zonal Office or NBR website

Step 2: Submitting filled in application form with supporting documents to the Zonal Office

Step 3: Verifying the documents by NBR officials

Step 4: Physical inspection of the business premises

Step 5: Obtaining a VAT Registration Certificate

|

|

Process Map

|

|

|

Required Document

|

- Fill-up an application form

- Enterprise Trade License.

- Bank Solvency Certificate.

- Owners 02 photograph

- National ID/Passport copy of owners.

- IRC/ERC if enterprise is doing Import and Export Business

- Article & Memorandum of Association (if enterprise is Limited Company.)

- TIN Certificate

- Location map of Enterprise premises

- Copy of BOI Registration

- Deed of Agreement

|

|

Time

|

1-2 Working day

|

|

Fee

|

No Charge

|

|

Contact

|

National Board of Revenue (NBR)

Segun Bagicha, Dhaka-1000

Phone: +88-02-9358223

Website: http://www.nbr-bd.org/

|

|

|---|

| Category | National Board of Revenue (NBR) |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |